The Hidden Costs of Not Having Travel Insurance as a Senior

Skipping travel insurance can be a costly mistake. Discover the potential financial burdens of medical emergencies, lost luggage, and trip cancellations. Protect yourself from unexpected expenses.

Why Senior Travel Insurance is a Must Have

Hey there, fellow travelers! Let's talk about something super important: travel insurance. Now, I know what you might be thinking: "Insurance? Sounds boring!" But trust me, when you're a senior exploring the world, travel insurance isn't just some stuffy policy – it's your safety net, your peace of mind, and frankly, a darn good investment. We're talking about protecting yourself from potentially HUGE financial hits that can totally derail your dream trip.

Think about it. You've saved up, planned meticulously, and are finally ready to embark on that long-awaited adventure. The last thing you want is for something unexpected to turn your dream into a nightmare. That's where travel insurance comes in, acting as a financial shield against the unforeseen.

Medical Emergencies Abroad: The Biggest Risk for Senior Travelers

Let's face it, as we get older, our bodies might not be as spry as they used to be. Medical issues can pop up unexpectedly, and getting sick or injured in a foreign country can be incredibly expensive. Your domestic health insurance, including Medicare, may offer limited or no coverage outside the US. Imagine needing emergency surgery in Europe or a sudden hospitalization in Asia – the bills could easily run into tens of thousands of dollars. Without travel insurance, you're on the hook for those expenses. That’s a scary thought! Travel insurance can cover medical expenses, emergency evacuation, and even repatriation (returning you home) if needed.

Trip Cancellations and Interruptions: Protecting Your Travel Investment

Life happens, right? A sudden illness, a family emergency, or even a natural disaster can force you to cancel or interrupt your trip. Without trip cancellation or interruption insurance, you could lose all the money you've invested in flights, hotels, tours, and other non-refundable expenses. This is especially true for those expensive cruises or long-duration tours! Travel insurance can reimburse you for these costs, allowing you to rebook your trip when you're ready. It’s like a do-over for your vacation!

Lost or Delayed Luggage: Replacing Essential Items and Avoiding Inconvenience

Lost luggage is a common travel woe, but it can be particularly problematic for seniors who may rely on specific medications, medical devices, or essential comfort items. Imagine arriving at your destination without your prescription medication or your special neck pillow. Travel insurance can reimburse you for the cost of replacing these items, as well as providing compensation for the inconvenience caused by delayed luggage. No more stressing about lost bags ruining your trip!

Pre-Existing Conditions: Finding Coverage and Peace of Mind

Many seniors have pre-existing medical conditions, such as diabetes, heart disease, or arthritis. It's crucial to find a travel insurance policy that covers these conditions. Some policies offer waivers that allow coverage for pre-existing conditions if you purchase the insurance within a certain timeframe of booking your trip. Don't let your health concerns keep you from traveling! Do your research and find a policy that meets your specific needs.

The Cost of Peace of Mind vs The Cost of Unforeseen Events

Okay, let’s talk money. Travel insurance IS an expense, but it’s an expense you can budget for and control. Consider it this way: a few hundred dollars for a comprehensive policy versus potentially tens of thousands of dollars in uncovered medical bills or lost travel investments. The peace of mind alone is often worth the cost. Think of it as an investment in your well-being and your financial security.

Specific Travel Insurance Products and Scenarios for Seniors

Alright, let's get down to brass tacks and talk about specific products and scenarios. Here are a few examples of how travel insurance can save the day, along with some specific product recommendations:

Scenario 1: Emergency Medical Evacuation in a Remote Location

Imagine you're hiking in the Andes Mountains when you suffer a serious injury. You need immediate medical attention, but the nearest hospital is hours away. Emergency medical evacuation coverage can pay for the cost of a helicopter rescue and transport to a qualified medical facility. This can easily cost upwards of $50,000 or more!

Product Recommendation: Consider policies from companies like Medjet or Global Rescue. These companies specialize in medical transport and evacuation services. While they might be pricier than standard travel insurance, they offer unparalleled peace of mind in remote or high-risk locations. A MedjetAssist membership, for example, starts around $300 per year.

Scenario 2: Trip Cancellation Due to a Sudden Illness

You've booked a non-refundable cruise to Alaska, but a week before your departure, you come down with a severe case of the flu. You're unable to travel, and you're worried about losing the thousands of dollars you've invested in the cruise. Trip cancellation insurance can reimburse you for these non-refundable expenses.

Product Recommendation: Look for policies with "Cancel For Any Reason" (CFAR) coverage. While CFAR policies are more expensive, they allow you to cancel your trip for any reason and receive a partial refund (typically 50-75% of your trip cost). Companies like Allianz and Travel Guard offer CFAR options. A CFAR upgrade might add 40-60% to the cost of a standard policy.

Scenario 3: Lost or Stolen Medications

You're traveling in Europe when your luggage is lost, and it contains all of your prescription medications. Without your medications, you could experience serious health complications. Travel insurance can reimburse you for the cost of replacing your medications and provide assistance in finding a local pharmacy.

Product Recommendation: Ensure your policy includes coverage for lost or stolen medications. Companies like World Nomads and Seven Corners offer comprehensive policies that include this coverage. Check the policy limits to ensure they are sufficient to cover the cost of your medications. A policy with $500 medication coverage is a good starting point.

Scenario 4: Pre-Existing Condition Flare-Up

You have a pre-existing heart condition, and while traveling in South America, you experience a flare-up that requires hospitalization. Travel insurance with a pre-existing condition waiver can cover the cost of your medical treatment.

Product Recommendation: Compare policies from companies that offer waivers for pre-existing conditions, such as Travel Insured International or HTH Worldwide. You'll typically need to purchase the policy within a certain timeframe of booking your trip (e.g., 14-21 days) to be eligible for the waiver. These policies may be slightly more expensive, but the peace of mind is invaluable.

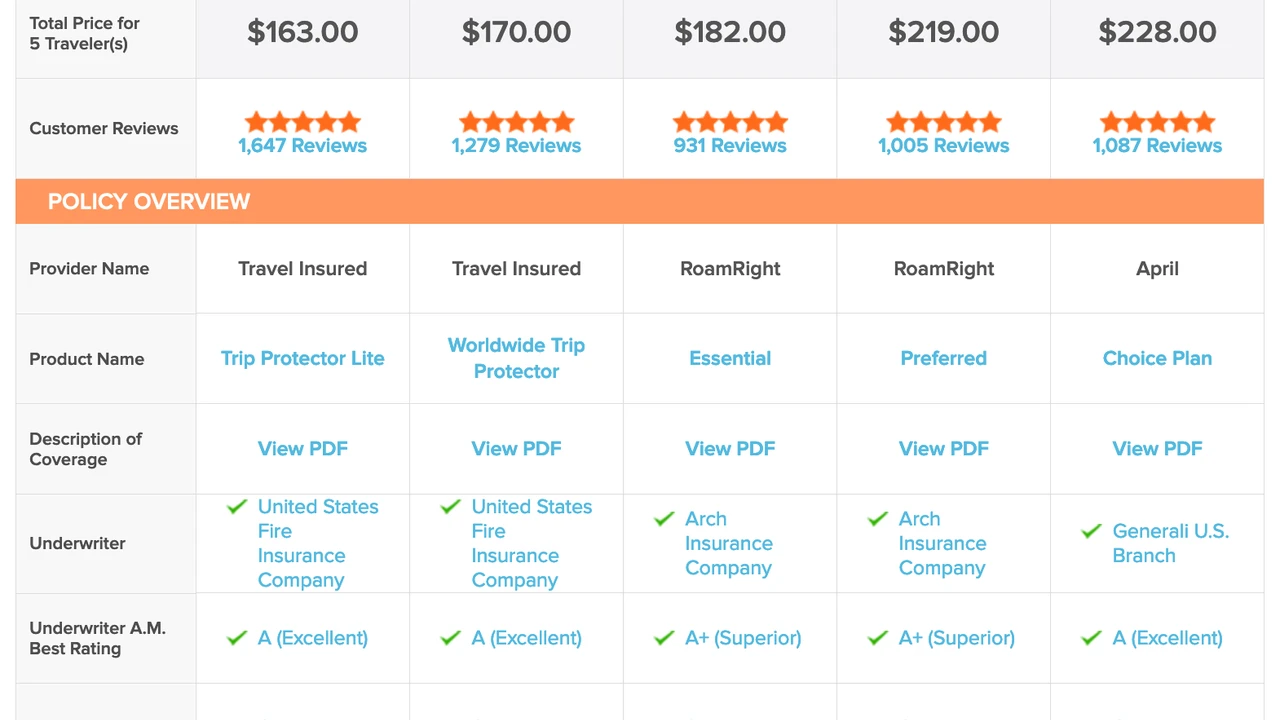

Comparing Specific Travel Insurance Products for Seniors

Here's a quick comparison of some popular travel insurance products for seniors:

| Company | Policy Name | Key Features | Approximate Cost (for a 70-year-old traveling for 2 weeks) | Pros | Cons |

|---|---|---|---|---|---|

| Allianz | AllTrips Premier | Trip cancellation, trip interruption, medical expenses, baggage loss, rental car damage | $250 | Comprehensive coverage, reliable customer service | Can be expensive, some exclusions for pre-existing conditions |

| World Nomads | Explorer Plan | Trip cancellation, trip interruption, medical expenses, adventure activities coverage | $180 | Good for adventurous travelers, flexible coverage options | May not be suitable for travelers with significant pre-existing conditions |

| Travel Guard | Platinum Plan | Trip cancellation, trip interruption, medical expenses, baggage loss, 24/7 assistance | $220 | Extensive coverage, excellent customer support | Can be difficult to understand the policy details |

| Seven Corners | RoundTrip Choice | Trip cancellation, trip interruption, medical expenses, pre-existing condition waiver | $200 | Good coverage for pre-existing conditions, competitive pricing | Customer service can be slow at times |

Disclaimer: Prices are approximate and may vary depending on your age, destination, trip length, and coverage options. Always compare quotes from multiple providers before purchasing travel insurance.

Final Thoughts: Don't Leave Home Without It

Look, I get it. Insurance isn't the most exciting topic. But when it comes to senior travel, it's an absolute necessity. It's about protecting your health, your finances, and your peace of mind. Don't let the fear of unexpected expenses keep you from exploring the world. Invest in travel insurance and travel with confidence, knowing that you're prepared for whatever may come your way. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)